This capital provides a layer of defense against potential losses, in the event that retained earnings begin to show a deficit. To illustrate, say Company B issues 2,000 shares of common stock with a par value of $2 per share. Paid-in capital is the total amount paid by investors for common or preferred stock. Say Company B issues 2,000 shares of common stock with a par value of $2 per share.

AccountingTools

Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services.

Paid in Capital in Excess of Par Explained for Finance Professionals

Once a stock trades in the secondary market, an investor may pay whatever the market will bear. When investors buy shares directly from a given company, that corporation receives and retains the funds as paid-in capital. But after that time, when investors buy shares in the open market, the generated funds go directly into the pockets of the investors selling off their positions. Diving deeper into paid-in capital, you may see balance sheets that include line items for common stock, preferred stock, and treasury stock.

How Does Paid-in Capital Increase or Decrease?

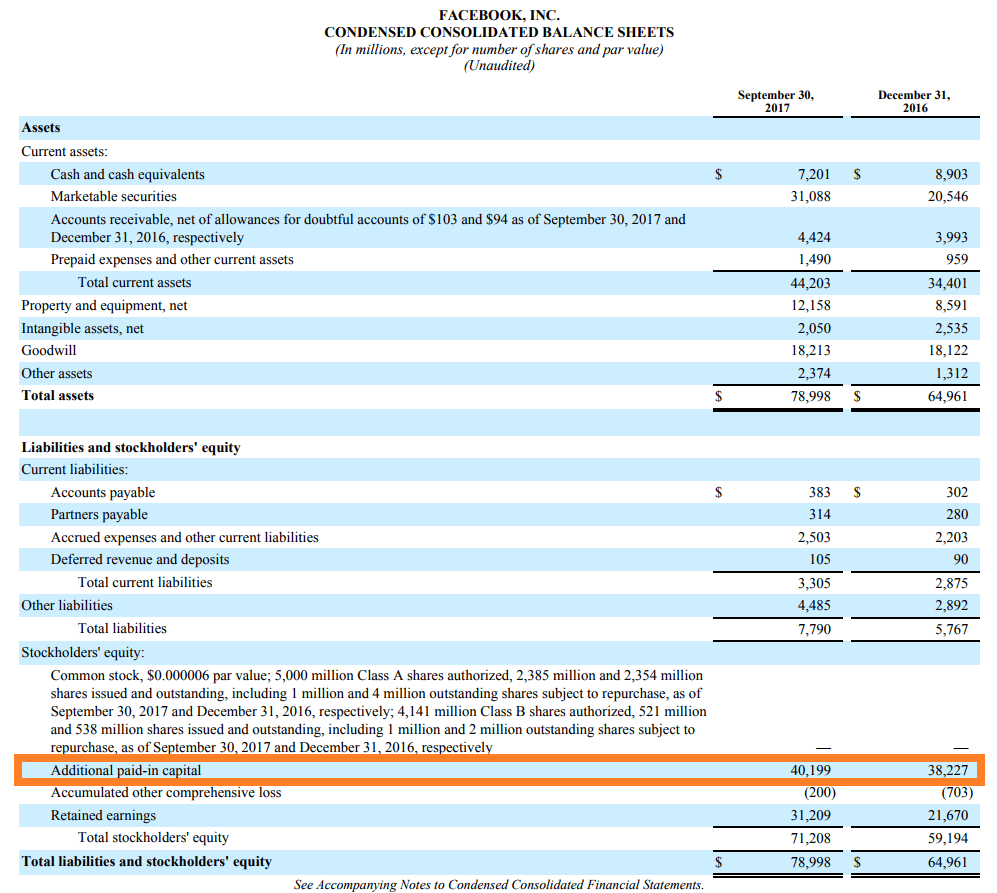

Let’s look at the stockholders’ equity section of a balance sheet for a corporation that has issued only common stock. There are 10,000 authorized shares, of which 2,000 shares had been issued for $50,000. At the balance sheet date, the corporation had cumulative net income after income taxes of $40,000 and had paid cumulative dividends of $12,000, resulting in retained earnings of $28,000.

When a company issues stock with a par or stated value, it records the sale as a debit to cash for the total amount of money they received from the sale. So initially in the balance sheet, the issued and paid in capital is recorded at the par value. After the amount has been paid by the investor, a new journal entry will be passed by recording the increase in the paid-in capital of the company. Due to the fact that additional paid-in capital represents money paid to the company, above the par value of a security, it is essential to understand what par actually means. Simply put, “par” signifies the value a company assigns to stock at the time of its IPO, before there is even a market for the security.

- By keeping cash on hand, an investor is more likely to be able to take advantage of opportunities as they arise, rather than having to sell other investments to raise the necessary funds.

- Paid in capital in excess of par, often found on the balance sheet, is a line item that can reveal much about a company’s financial journey.

- Paid-in capital represents the funds raised by the business through selling its equity and not from ongoing business operations.

- An established corporation that has been profitable for many years will often have a very large credit balance in its Retained Earnings account, frequently exceeding the paid-in capital from investors.

Excess working capital provides some cash cushion against unexpected expenses and can be reinvested in the company’s growth. A ratio below 1.0 is unfavorable, as it indicates the company’s current assets are not sufficient to cover their near-term obligations. When companies issue an initial public offering (IPO), additional shares or a secondary offering, they do so in the primary market. This excess received from stockholders over par-valueor stated-valueof the stock issued is also called contributed capital in excess of par. Also known as contributed capital, this contribution marks the capital investors invest in the shares of a company. When this par value figure exceeds and shareholders or investors pay more than the par value for the share, it becomes additional paid in capital.

An alternate interpretation is that additional capital paid equals already paid, excluding par value from the definition. So, when discussing paid-in capital with others who might have a different understanding of the phrase, you need to be clear on the definition. In this case, it signifies the face value that a business gives to a particular stock during its IPO.

Common stock is a component of paid-in capital, which is the total amount received from investors for stock. Paid-in capital appears as a credit (that is, an increase) to the paid-in capital section of the balance sheet, and as a debit, or increase, to cash. A company certainly has a great interest in its stock price from day to day, but not because its balance sheet is immediately affected for better or worse. It refers solely to the amount that shareholders have paid over the par value of the stock. This account is separate from the common stock or preferred stock account, which records the par value of the issued shares.

Afterward, let’s say a company wants to raise funds by issuing more share capital. I.e., funds are required for any capital expenditure or other large business transactions. Then, the company will issue more share capital, and the investors will pay up the amount. After the investor has paid the amount, a new journal entry will be passed by recording the increase in the paid-in capital of the company.

That balance reduces the company’s total shareholders equity into negative territory. And additional paid-in capital is also known as capital in excess of par value or capital surplus. Read on to learn the nuances of paid-in capital and how it relates to other shareholders equity line items like additional paid-in capital, retained earnings, and treasury stock. paid in capital in excess of par The paid-in capital of a company measures the total cash that shareholders contributed to the company in exchange for the receipt of shares in the company. Additional paid-in capital represents the extra $1 investors paid to the company above its original $1 par value. What you pay when investing in company stock may be different from its par value.

This is because if one investment loses value, the other investments in the portfolio may offset those losses. These materials were downloaded from PwC’s Viewpoint (viewpoint.pwc.com) under license. The sum raised equals the Par value plus any Additional Paid-In Capital over the Par Value. When you’re valuing a stock, you want to always make sure that you can be as accurate as possible. Furthermore, purchasing shares at a company’s IPO can be incredibly profitable for some investors.