This method is simple and efficient when the cost can be directly traced to a single cost object. By seeing how cost allocation works in these enterprise environments, you’ll better understand its practical application and significance across different sectors. Let’s say there is a company that is engaged in certain operations and spends $12,000 for raw materials, $8,000 for labor costs incurred to produce the good and fuel worth $3,000 to only production related works.

Methods of Cost Allocation

Each of these equations includes two unknowns, thus determining S1 and S2 requires solving the equations simultaneously. Although simultaneous equations are notnormally solved by hand in practice, one method is presented in Exhibit 6-6 to illustrate the concept. Observe that the denominator for the proportion of service provided from S1 to S2 is 900, not 950. This is because the 50 KWH’s of self service are ignored in thestep-down method. In industries like telecommunications, healthcare, or utilities, regulatory bodies impose stringent requirements for how costs must be allocated.

- If the company uses the sales value at the split-off point as the allocation basis, the products will appear to be equally profitable at the point of separation.

- The Assembly Department manager is likely to complain that neither of the allocations in Exhibit 6-11 is equitable.

- This approach involves allocating the joint costs to products in proportion to these estimated sales values.

- If not, cost allocation can inadvertently communicate non-commitment to external stakeholders, potentially adversely affecting the organization’s reputation and market position.

Step-Down Method of Cost Allocation: Example, Calculation

Some organizations may also choose to use multiple allocation bases for different types of costs to minimize this arbitrariness. For example, suppose the Virginia Chicken Company can sell chicken parts such as feet, beaks and gizzards for five cents per pound at the split-off point. Since these parts ofthe chicken have relatively little value, they tend to fall into the category of by-products.

Managerial Accounting

These tools can automate the allocation process based on predefined criteria, reducing the risk of human error and ensuring more accurate financial reporting. The allocation of indirect costs requires different methodologies, such as overhead allocation rates or activity-based costing, to distribute these expenses across various departments or products. This distinction is crucial for accurate financial reporting and cost control. By separating direct and indirect costs, businesses can better understand their cost structure and identify areas for efficiency improvements. For example, a company might discover that its indirect costs are disproportionately high, prompting a review of its overhead expenses to enhance profitability. If different products consume indirectresources in different proportions in the various departments, then using departmental overhead rates will provide more accurate product costs than usinga plant wide rate.

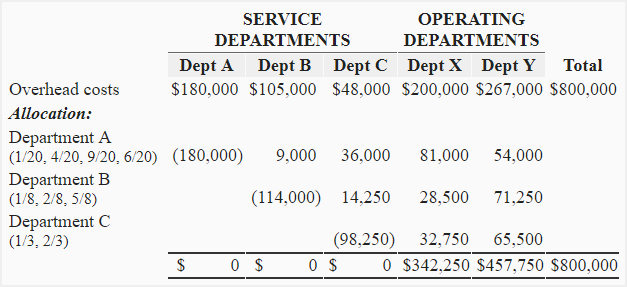

Theserelationships affect the choice of allocation methods, as well as the accuracy of the first stage cost allocations. The step-down allocation method, also known as sequential allocation, is more sophisticated than direct allocation. It involves allocating costs from service departments to production departments in a sequential manner. The process begins with the service real estate department that provides the most services to other departments, and then moves on to the next, and so forth. For example, in a hospital, the costs of the housekeeping department might be allocated first, followed by the costs of the maintenance department. This method acknowledges the interdependencies between departments, offering a more nuanced view of cost distribution.

Unlike traditional methods that may allocate costs based on simplistic metrics like direct labor hours or machine hours, ABC delves deeper into the specific activities that drive costs. By identifying and analyzing these activities, organizations can achieve a more precise allocation of overhead costs, leading to more accurate product costing and profitability analysis. The General Products Company is a manufacturing firm with six service departments and five producing departments. Many of the service departments serve each other in addition to providing service to the producing departments. The various departments and applicable variable direct cost, (i.e., the cost identified with these departments before reciprocal service cost allocations) are presented in Table 1 for the most recent accounting period. The service departments and allocation proportions for the direct variable costs appear in the lower part of Table 1.

These platforms offer detailed insights into material usage, labor hours, and other direct expenses, enabling companies to make data-driven decisions. To allocate the service department costs to eachoperating department, we will take the amount of the cost driver(machine hours for maintenance and employees for administration) xthe allocation rate we just calculated. Cost pools are essentially aggregations of individual costs that relate to a specific task or factor.

The technology sector presents another unique perspective on direct costs. In software development, direct costs often encompass the salaries of developers, the cost of software licenses, and expenses related to cloud services used in the development process. For instance, a tech company developing a new application would consider the wages of its programming team, the cost of development tools, and server expenses as direct costs. These costs are essential for project budgeting and financial planning, ensuring that the development process remains within financial constraints. These are raw materials and supplies that are consumed in the production process and can be directly linked to the final product. Examples include the steel used in car manufacturing, the flour in a bakery, or the fabric in a clothing factory.