![]()

Using data mined from your CRM — along with more in-depth forecasting methods — can help you make more consistent, accurate forecasts. The percent of sales method is one of the quickest ways to develop a financial forecast for your business — specifically for items closely correlated with sales. If your business needs a very rough picture of its financial future immediately, the percent of sales method is probably one of your better bets. With a revenue of $60,000, she’s not running a corporation, but she should still expect to run into a small amount of bad debt expense. By looking over her records, she finds that for the month, her credit purchases come to $55,000 (with $5,000 bookkeeping cash). To calculate your potential bad debts expense (BDE), simply multiply your total credit sales by the percentage you anticipate losing.

Less Accurate for Fast-Growing Businesses

And second, it can yield high-quality forecasts for those percentage of sales approach items that closely correlate with sales. Joist helps manage sales, streamline operations, and create detailed estimates and invoices. These capabilities contribute to a clearer understanding of your financial situation. These drawbacks show why other financial forecasting techniques are needed. Profitability ratios, for example, are an excellent tool for a more detailed and accurate financial forecast.

Calculate forecasted sales.

Ultimately, the percent of sales method is a convenient but flawed process of financial forecasting. The best and most reliable method is to use your own business’s past numbers and performance. Look at the previous year’s numbers and determine how much bad debt you had. Calculate that as a percentage of your total accounts receivable. To get the most accurate number, you may want to look at the past several years and arrive at an average.

The Percent of Sales Method: What It Is and How to Use It

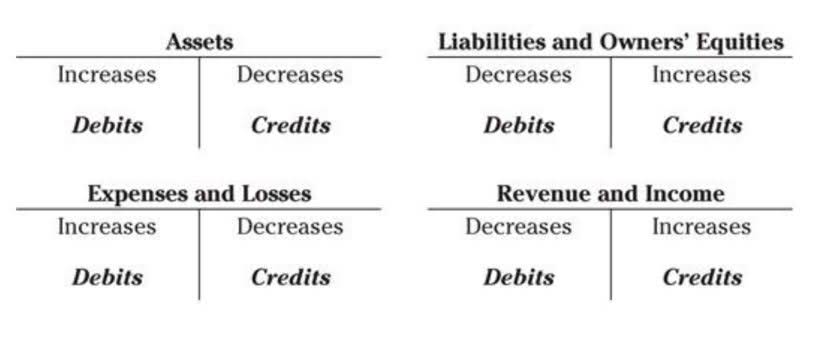

Organizing the data before calculating can improve the process’s efficiency and accuracy. Businesses can use different methods to arrive at an actual number, and they use this estimate to offset their projected gross income or sales for the year. They may use past percentages, compare their numbers to businesses in the same sector, other factors, or a combination of these. According to the team at Lumen Learning, no matter how you arrive at the amount, the percentage of receivables method is essentially a way of calculating uncollectable accounts. Reviewing historical data of uncollectible accounts and the industry benchmark for bad debt expenses can work out the percentage needed for the forecast. Because the percentage-of-sales method works closely with data from sales items, it’s not the best forecasting method for things like fixed assets or expenses.

Formula

The percentage-of-sales method works by applying a set percentage of a company’s budget to advertising. The actual dollar amount to advertise each product is based on the amount of sales for that product or its market share. The advantages of this method are that it keeps strong products well-advertised and that it can be changed at each budget based on actual sales or future forecasts.

- In some ways, the percentage of receivables method is a type of percentage of sales.

- In this step, businesses hope to obtain positive percentages in all accounts.

- Especially when it comes to creating a budgeted set of financial statements.

- Leverage the percentage of sales method to get a clear vision of your financial future so you can map strategies that work.

- She estimates that approximately 2 percent of her credit sales may come back faulty.

- Organizations wanting to use a forecasting technique that is free of cost and can offer a better chance of success for future sales opt for this method.

- The greatest disadvantage is that advertisers disagree that sales should determine advertising, instead feeling that advertising actually drives sales.

- This includes things like accounts payable, accounts receivable, cash, cost of goods sold (COGS), fixed assets, and net income.

- Organizing the data before calculating can improve the process’s efficiency and accuracy.

- Quickly surface insights, drive strategic decisions, and help the business stay on track.

From there, she would determine the forecasted value of the previously referenced accounts. When performing any financial calculations, accurate data is your number-one priority. With Zendesk Sell, keeping track of your customers and your transactions is easy. Our CRM platform is user-friendly, compatible with existing software, and workable with hundreds of additional software companies. The company then uses the results of this method to make adjustments for the future based on their financial outlook. The store owner needs to look at each line item on the financial statement and work out the percentage in relation to revenue.

Understanding the Percent of Sales Method: A Simple Guide for Learners

Multiply the total accounts receivable by the historical uncollected accounts percentage to predict how much these bad debts might cost for the time period. Then you apply these percentages to the current sales figures to create a financial forecast, which includes the income and spending accounts. The percent of accounts receivable method is used by businesses and business sectors to determine how much bad debt they expect to incur compared to sales. This occurs for several reasons, but sound businesses need to anticipate some bad debt. A business would need to forecast the accounts receivable or credit sales using the available historical data. Understanding how quickly customers pay back credit sales over different periods, such as 30, 60, and 90 days, also helps.

Calculate your total sales for the period and then calculate the total costs for that same period, HubSpot explains. Multiply that number by 100 to provide the percentage of sales to costs. Most business owners will want to forecast things like cash, accounts receivable, accounts payable and net income. The percentage of sales method provides a straightforward way to forecast financial figures. This helps businesses get a sense of their short-term financial outlook.