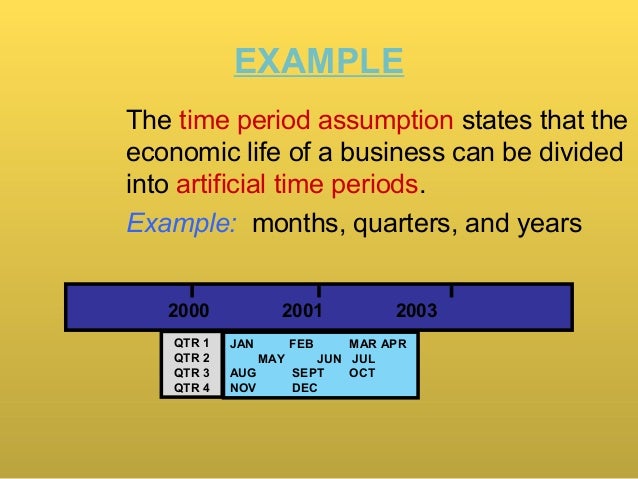

The model requires that revenue be recognized when it is earned and realizable, which is often interpreted as over the time the service is provided or the product is used. However, this can lead to revenue being reported in a way that does not align with the actual value delivered to the customer. The time period principle is the concept that a business should report the financial results of its activities over a standard time period, which is usually monthly, quarterly, or annually. Once the duration of each reporting period is established, use the guidelines of Generally Accepted Accounting Principles or International Financial Reporting Standards to record transactions within each period. Even though the going concern assumption dictates that businesses should be treated as if they will continue indefinitely, it is helpful to view business performance in shorter time frames.

Which financial statements are we talking about?

If it recognizes revenue only upon project completion, its financial statements might show no revenue for several periods followed by a large influx once a project is finished. This can mislead stakeholders about the company’s ongoing financial health and operational efficiency. In agriculture, the time period assumption is used to match costs with the revenues of a particular crop cycle. This can be complex due to the varying lengths of crop cycles and the influence of external factors like weather.

Why You Can Trust Finance Strategists

In the end, it will lead to the wrong decision due to a misunderstanding of the accounting period. The Monetary Unit Assumption states that all business transactions must be measured and recorded only in terms of a common unit of measurement which is money. Debitoor invoicing software aims to help you comply with accounting principles by using an automated system to match your transactions as easily and quickly as possible. One of the features in our larger subscription plans allows you to upload your bank statements which will automatically match each payment to the corresponding invoice or expense.

The Role of Time Period Assumption in Financial Reporting

The Time Period Assumption requires that the company divides its business activities into equally measured time intervals which are called accounting periods. Just like the time period principle, there are a few other accounting principles with are also concerned with income measurement assumptions. The financial statements of any business tell a story of the business’s activities and their position at a certain point in time. Therefore, the importance of the time period principle is to inform any readers about the time period for which the financial statements have been prepared.

To Access Performance and Set Overall Business Strategy

If a company is operating in a hyperinflationary economy, then its financial statements should be restated to reflect the changes in the general purchasing power of the functional currency. In any of these scenarios, liquidation or winding up procedures will take place in your business. Proper disclosure in the financial statements together with the reasons and different measurement basis to be used should be made when the going concern assumption ceases to apply. In the case of a sole proprietorship, accounting software the law considers the business and the proprietor as a single entity wherein the liabilities of the business may extend to the personal properties of its owner. The proprietor also reports the income of the business in his or her personal income tax return rather than on a separate tax return. However, at the viewpoint of accounting, the owner and the proprietorship business are still considered as two separate entities, with their transactions being accounted for separately.

- Instructions After analyzing the accounts, journalize (a) the July transactions and (b) the adjusting entries that were made on July 31.

- It is stated that the total revenue is $100 million, but there is no information provided regarding how it was collected or which months were particularly successful or failed.

- Regulatory bodies, such as the securities and Exchange commission (SEC), require public companies to follow GAAP to prevent fraudulent reporting and financial misrepresentation.

- These challenges underscore the importance of transparency, consistency, and adherence to accounting principles to ensure that financial statements are useful for decision-making.

Basic accounting principles

The Time Period Assumption is a cornerstone of generally Accepted Accounting principles (GAAP) that ensures financial information is presented in a manner that is both meaningful and manageable. It allows for the periodic measurement of financial performance, which is essential for internal management, investors, creditors, and regulatory bodies. By adhering to this assumption, businesses maintain consistency, comparability, and reliability in their financial reporting, which is vital for maintaining trust and transparency in the financial markets. From an investor’s perspective, the time period assumption is vital for assessing a company’s performance trends over time. Investors rely on periodic financial statements to make informed decisions about buying, holding, or selling stock. If a company chooses to defer revenue recognition, it may appear less profitable in the short term, potentially affecting stock prices and investor confidence.

It ensures that financial statements are meaningful and that the performance of a business is accurately reflected, irrespective of the length of its operations or the timing of its cash flows. This assumption, while simplifying financial reporting, also requires careful judgment in its application to ensure that the financial information remains relevant and reliable. From an accountant’s perspective, periodicity allows for the systematic recognition of revenues and expenses within the appropriate accounting period. This is crucial for the preparation of income statements that reflect the financial performance of a company over a specific period, be it monthly, quarterly, or annually. On the other hand, interim reporting offers a more frequent glimpse into a company’s operations, typically on a quarterly basis. These reports are essential for providing timely information to investors and other stakeholders, allowing them to make informed decisions between annual reports.

The revenue recognition over the project’s life can significantly vary depending on the chosen accounting methods and the timing of milestone completions. If the company uses the percentage-of-completion method, it will recognize revenue based on the project’s progress, which may not align with the time periods defined by the fiscal year. The time period assumption is not just a technicality in accounting; it is a practical tool that shapes the way modern businesses operate and report their financial activities. It supports various stakeholders in making informed decisions and ensures that the financial information presented is relevant, reliable, and comparable. Without this assumption, the financial landscape would be chaotic and incomprehensible, underscoring its significance in the realm of modern accounting. To illustrate, consider the case of a tech startup that uses cloud-based accounting software to manage its finances.